Today, I’am going to write a very useful blog for you all.

I've often encountered situation, where people come to me saying that their

employer has not provided them Form 16 or the Employer is not able to provide

Form 16 on time etc. This issue is putting them in trouble to file their income

tax return or to meet their other obligations. In order to solve this problem I

have come out with this blog that how you can get Provisional Form 16 by yourself

without going to your employer. But one most important point to this is that

firstly, the employer must have paid your tax deducted to the government and

secondly must have filed the return for the same. Conclusively if the employer

has fulfilled his obligations then the provisional Form 16 will show the exact

same details as the original Form 16. With this method you can download your

form 16 on provisional basis which will be concise. I have personally done this

for many of my clients and it does work.

What is Form 16 ?

Form 16 is the TDS Certificate for Salaried Person with complete salary and other details bifurcation. It is provide by Employer.

Without wasting any more time let’s start learning and download

your Provisional Form 16 in just 2-3 minutes.

Prerequisite :

·

Income

Tax Login & Password

·

TAN

of Deductor

Step 2 : Click on the website link and go to its home page.

Step 3 : Login to your Income Tax Id :-

1.

You

will first find an information Screen. Close the Screen. And Click over the

“Login here” Button showing at the upper left side of the screen.

2. Login

window will appear.

3.

Fill

in your User Id and Password. Your PAN number will be your User Id.

4.

Fill

in the captcha code and click on “login”

Step 4 : View “26 AS” :-

1.

Go

to the menu bar of your Income Tax Id Home Page.

2.

Click

on “My Account”

3.

Select

“View Form 26 AS”.

4.

In

the Confirmation Window, Click on “Confirm” button.

Step 5 : Navigate to “Traces” website :-

2.

From

the dialogue box appearing on the homepage of “Traces” website. Tick the

checkbox and click proceed.

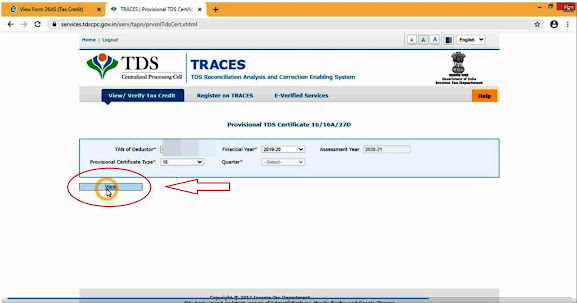

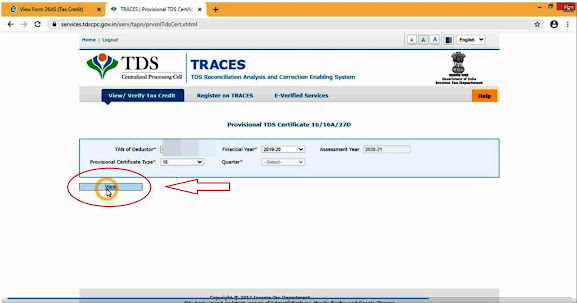

Step 6 : View Provisional Form 16 :-

1.

From

the menu bar Click “view / verify tax credit”.

2. From

the drop-down menu select “Provisional TDS Certificate form 16/16A/27D”

3. In

the new screen appearing, Fill in the TAN of the deductor and select the

financial year and assessment year will be automatically filled.

4.

From

the Provisional certificate type option, select “Form 16”

5.

Click

on “View”

6.

Provisional

Form 16 will be displayed on the Screen.

Step 7 : Save Provisional Form 16 :-

1.

Right

Click on the Provisional Form 16 appearing over the screen.

2.

Click

“Save As” from the drop down option.

3.

Save

As Dialogue Box Appears.

4.

Enter

the name of the file (if want to change the default name).

5.

Default

format is HTML.

6.

Click

on “Save”.

Step 8 : Open Provisional Form 16

The Provisional Form 16 is saved in HTML format so you can

open it in any internet browser without

the internet connection. So open it in

any Internet Browser.

This is the simplest way to get your Form 16 in just three

minutes without troubling yourself too much.

Thank you for giving your valuable time. I tried my best to

give the simplest way to do your work. Hope you all like it. Please leave your

comments and opinions in the comment box below.

Don't forget to like and subscribe my blog to get such useful

updates.

Have a great day ahead….

Do follow,subscribe and like us at facebook, Instagram and youtube to keep getting such useful informations.

Visit our youtube page : www.youtube.com/c/TaxolawgyWithPriyankaTiwari

Visit our Instagram Account : https://www.instagram.com/taxolawgywithpriyankatiwari/

Visit our Facebook page : https://www.facebook.com/taxolawgywithpriyankatiwari/

Disclaimer :

The above blog is purely for educational and guidance purpose. It's just the reflection of the author's personal experience and judgment. The author has just provided the general information & understanding and its not at all an alternative of any legal advice or practitioner. It has no connection with the websites mentioned in its contents. The content stated in the blog should be used by the reader at his own discretion and sole responsibility. The content of the blog can be only used for any other document, write-up, article, blog and any written or printed material whether on paper or digitally in any form, with the prior permission of the author.