Income Tax Return verification is a must to submit your Income Tax Return. This is a huge headache for many people. Today I’am going to share one of the simplest method to EVerifying Income Tax Return. We are going to generate “Electronic Verification Code” abbreviated as “EVC”. This Electronic Verification Code (EVC) will be generated by linking Bank Account. For generating this Electronic Verification Code (EVC) a mobile no and E-mail id should be registered with your bank in respect of the bank account.

E-Verification of Income Tax Return will not be a headache any more. With this method we are going to very easily E-verify income tax return. The Bank Account linked mobile number and Email id registered with the respective is really important because this will be used to receive the Electronic Verification Code (EVC). For this process we required to have :

1. 👉 Income Tax login Id & password

2. 👉 Bank account details : Bank account no., IFSC (Indian Financial System Code)

3. 👉 Bank Registered (with the Bank account) : Mobile number & Email id

This mobile number and Email id is really important because this will be used to receive the Electronic Verification Code (EVC). Now the step by step process is discussed below.

Step 1 : Search www.incometax.gov.inGo to your internet browser and search

www.incometax.gov.in

Step 2 : Click over Login

Look on the homepage, at the upper left corner of the screen. Click over “Login here”.

Step 3 : Login your User ID

Now you will see the Login Screen. It will ask your “User Id” and Password. Remember guy, “User Id” will be your PAN (Permanent Account no) itself. Fill in your User Id and Password over the space provided. Fill in the Captcha Code as appearing and then click over “login”.

Step 4 : Generate

EVC

Your Dashboard will appear as you will login. From the Menu Bar, Click over “My Account” (Second option from the Right) and go to the drop down menu. From the dropdown menu select “Generate EVC”.

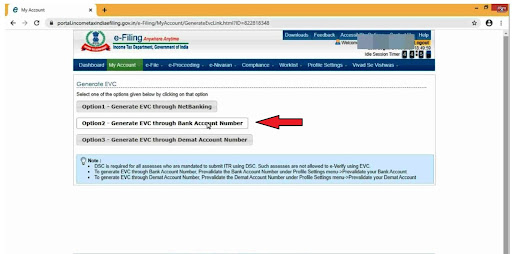

It will show three option to Generate EVC

1. Option 1 : Generate EVC through NetBanking

2. Option 2 : Generate EVC through Bank Account Number

3. Option 3 : Generate EVC through Demat Account Number

From the above three option, select Option 2 : Generate EVC through Bank Account Number.

Step 5 : Prevalidate

your bank account

Over the "Prevalidate your bank account" dialogue box, click over “Prevalidate your bank account” button.

Now you will be asked for evaluating your bank account details. Fill in your bank account details like a bank account number, account type, IFSC (Indian Financial System code). After filling the IFSC (Indian Financial System code), bank name and branch name +will be auto populated. Fill-in the registered mobile number & email id provided in your bank account to the respective Bank. This is very important as the registered mobile number & email id should match with the one provided by you otherwise this procedure will not proceed. Now click over “Prevalidate”.

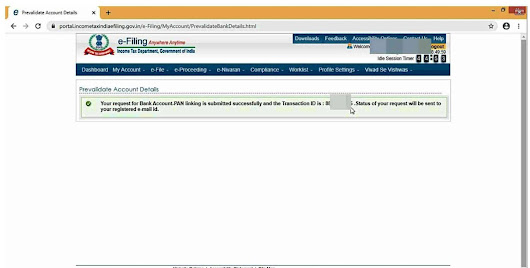

Step 6 : Prevalidation

Done : Transaction Id will be Generated.

After Prevalidation you will receive a Transaction ID under message saying “Your request for Bank account-PAN linking is submitted successfully and Transaction ID is : ……………Status of your request will be sent to your registered e-mail id.

Step 7 : Enable EVC

Once again go to the Menu Bar, Click over “My Account” (Second option from the Right) and from the drop down menu, select “Generate EVC”.

It will show three option to Generate EVC

1. Option 1 : Generate EVC through NetBanking

2. Option 2 : Generate EVC through Bank Account Number

3. Option 3 : Generate EVC through Demat Account Number

From the above three option, select Option 2 : Generate EVC through Bank Account Number.

Prevalidated Bank Details will appear. It will be your Bank details as filled in Step 5, such as bank account number, account type, IFSC code, mobile number, email id and status will be shown as validated. select the check box and click over “Enable EVC”.

Step 8 : Generate EVC

Over the next screen you will see the message, “selected bank account is enabled to generate EVC”

Now again follow the same procedure, go to “My Account” (Second option from the Right) and from the drop down menu, select “Generate EVC”.

Prevalidate Bank Detail Dialogue box will appear which will ask for generating EVC over the verified mobile number and email id. Select “Yes”. Next Screen will show text, “EVC Generated successfully”. EVC will be send to the Verified Mobile no. and Email ID.

EVC generated can used for next 72 hours to verify income tax return.

This is one of the simplest method to E-Verify your income tax return with the help of your bank account. Tried the best to simplify the whole process & to make it easy for you all to understand. If you liked the blog please share it with the friends to help them as well. Like, subscribe and share your valuable comments. If you have any advice and query, feel free to comment.

Do follow,subscribe and like us at facebook, Instagram and youtube to keep getting such useful informations.

Visit our youtube page : www.youtube.com/c/TaxolawgyWithPriyankaTiwari

Visit our Instagram Account : https://www.instagram.com/taxolawgywithpriyankatiwari/

Visit our Facebook page : https://www.facebook.com/taxolawgywithpriyankatiwari/

Disclaimer :

The above blog is purely for educational and guidance purpose. It's just the reflection of the author's personal experience and judgment. The author has just provided the general information & understanding and its not at all an alternative of any legal advice or practitioner. It has no connection with the websites mentioned in its contents. The content stated in the blog should be used by the reader at his own discretion and sole responsibility. The content of the blog can be only used for any other document, write-up, article, blog and any written or printed material whether on paper or digitally in any form, with the prior permission of the author.