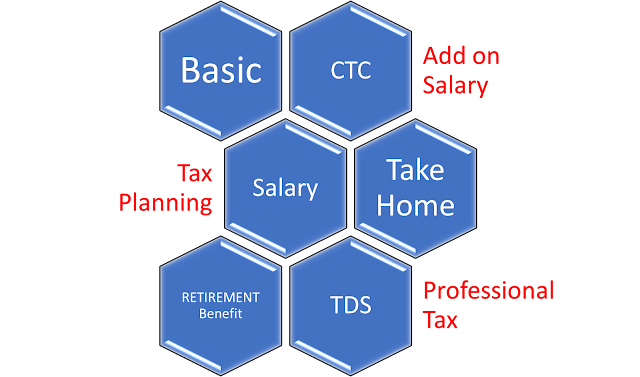

It's high time that everyone should understand their salary pay and plan accordingly. I have had numerous interactions with fresher employees who won't have any idea about their actual salary, take home salary and CTC etc.

Understanding your Salary bifurcation is crucial in salary negotiation as well. Salary is an important aspect of employment that not only pays your bills but also determines your standard of living. As a salaried employee, it's important to understand the various components of your salary in the employment agreement.

Basic Salary

As the same suggests, basic salary is the fixed amount of money paid to an employee excluding any other allowances or benefits. This amount is determined by the employer and is usually a fixed percentage of the total salary. The basic salary is the foundation of the salary structure and is used to calculate other components of the salary. It is the one which should be looked at the very first as it is fully taxable.

Take Home Salary

It is the salary you are paid in cash form. Take-home salary is the net amount that you receive after all the deductions from your salary. It is the amount that is credited to your bank account on a monthly basis. Take-home salary is calculated by deducting various taxes and other deductions such as provident fund, professional tax, and income tax from the gross salary.

Allowances/Add on Salary

In simple terms, it is addition to your basic salary. Add-on salary is the amount of money paid to an employee as an additional component to the basic salary. This includes various allowances such as House Rent Allowance (HRA), Dearness Allowance (DA), and Conveyance Allowance (CA). These allowances are usually paid to employees to cover their expenses related to rent, transportation, and other costs.

Reimbursements

The expenses which are incurred in relation to employment and discharge of official duties are reimbursed or repaid by the employer to the employee as were initially paid by the employee. Like telephone bill reimbursement or broadband bill reimbursement.

Retirement Benefits

That part of salary which is deducted and paid for your retirement life and it’s planning. Retirement benefits are the amount of money paid to an employee after they retire from their job. These benefits include Provident Fund (PF), Employee Provident Fund (EPF), and Gratuity. PF and EPF are mandatory contributions made by the employee and the employer towards the employee's retirement savings. Gratuity is a lump sum amount paid to the employee by the employer as a gesture of appreciation for the employee's long-term service.

Gratuity

Gratuity is a lump sum amount paid to an employee by the employer as a gesture of appreciation for the employee's long-term service. Gratuity is calculated based on the employee's last drawn salary and the number of years of service.

CTC

CTC stands for Cost to Company, which is the total amount of money that an employer spends on an employee annually. CTC includes all the components of the salary, such as basic salary, allowances, and retirement benefits.

TDS (Tax Deduction at Source)

Employers deduct tax from salary paid to employee's salary and pays it to the government on behalf of the employee. They incorporate all other income component and then calculate tax.

Professional Tax Deduction

Professional tax is a tax levied by the state government on individuals who earn an income. This tax is deducted by the employer from the employee's salary and paid to the state government on behalf of the employee.

Provident Fund Provident

Provident Fund is a retirement savings scheme in which both the employee and the employer contribute a fixed percentage of the employee's salary towards their retirement savings. The contributions made towards Provident Fund are tax-free up to a certain limit.

Tax Planning

Tax planning is the process of managing your finances in a way that helps you to plan your investment and minimize your tax liability.

The deduction and planning over each element will be discussed in my next blog post. Stay tuned and share your comments.

Do Refer the below for benefits :

Taxolawgy With Priyanka Tiwari: How to Safe Tax over Arrears or Advance of Salary Received

Taxolawgy With Priyanka Tiwari: How to Get Form 16 Yourself in 3 Mins

Taxolawgy With Priyanka Tiwari: How to Check Income Tax Refund Status

Taxolawgy With Priyanka Tiwari: How to apply for PAN (Permanent Account No.) Online and Get it in One Hour