"Every

Penny saved is Every Penny Earned". Salary is the sole source of income for many

people. Many of the time salary increment is made due and afterwards paid as arrear salary in the next financial year or subsequent financial year. There might be other reasons as well for this

arrear salary receipt. In this Covid 19 pandemic it is most likely to expect

that many employees are going to receive their salary in the form of arrears in

upcoming financial year. These arrears of salary attracts Extra Tax burden. And

many of the people unknowingly pay this extra tax. With this blog I ‘am going

to share the tax saving tool with the help of which you can save this extra tax.

YES,

this EXTRA TAX payout over arrears of salary can be SAVED by claiming relief. Right

now your mind must be full of curiosity, like what, how, when etc. Let’s

understand everything in simple and easy manner without wasting any more time. Lets discuss the whole concept.

Arrear

Salary

Arrear

Salary is the salary for any past previous financial year, which is received in

the current financial year. For example, as central government has paid their employees

the 7th grade pay salary in the current financial year (2019-2020)

in the form of arrear salary.

How

does Arrear Salary Troubles Employees ?

It

is a very clear concept that you have to pay tax on your current year earnings

and every person does that as a normal routine in very financial year. But

when it comes to receiving arrears the income of the financial year in which it

is received turns to increase, which results in increase in salary of the

respective financial year. Due to this increase in salary the tax liability

increase after receiving Arrears :-

— As it is an EXTRA SALARY over your

usual SALARY, its increases the taxable income of the employee and conclusively

ATTRACTS more tax.

— It might take your income from exempt

income level i.e. non-taxable income to taxable income level.

— It might disown/disallow you from the

tax rebate of Sec. 87A, which is a kind of tax discount provided to assessee.

Tax Rebate for F.Y. 2020-21 is Ruoees 12500.

Usually

the employer deducts tax on employee’s salary in the form of TDS (Tax Deducted

at Source). And this usual routine happens in the year of receipt of arrear

salary as well. The employer deducts TDS in the year of receipt of arrear

salary which is a higher tax amount as is deducted over arrear salary too.

Why

High Tax Burden ?

In

case of receiving arrear salary the irony is that in one hand you are receiving

extra salary but on the hand you are also receiving extra tax burden. The

actual fact is that arrear salary belongs to a previous financial year but is

received in the current financial year. The employer deducts the TDS on the

basis of current year salary receipt.

Now

the big question is how we can save this extra tax liability. In the normal

course of business if this arrear salary would have been received by the

employee in the previous year to which it belong the tax burden might had been

mitigated or lessen. If it was received in the previous year of its belonging

the tax might be less as the respective year income was less, but it is paid as

an add-on the current year income it results in higher tax liability.

How

to save this Extra Income Tax ?

The

answer is “Claim Relief under Section 89 (1) of the Income Tax Act”. Its says

that if an assessee receive salary in arrear or advance in a financial year or

receive more than 12 month salary in a financial year may be given relief for

the same under the section by the Assessing Officer. The Assessing officer provide relief on the basis of Form 10E Filed and Income Tax return submitted. It provide relief from the

tax which is excess as compared to the actual tax liability. For this it has

the below explained calculation.

How

to Claim Relief under Section 89 ?

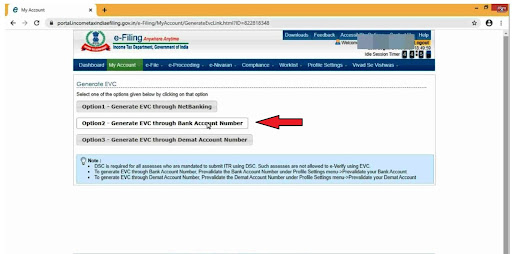

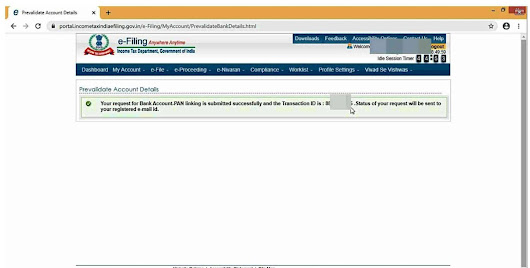

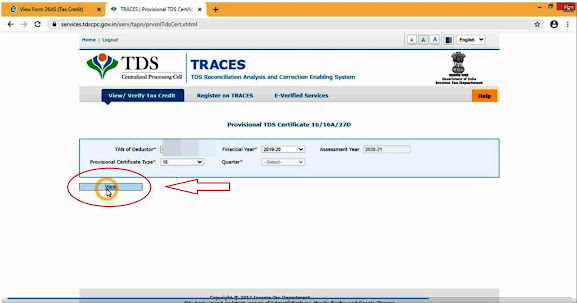

File

“Form 10 E” online to avail the benefit under Section 89. After filing “Form

10 E” file your income tax return for the respective financial year and claim

relief under Section 89 in the respective income tax return.

How

the calculation is done for the relief ?

The

calculation can be understood in the following steps :

Step 1 : The Excess Tax paid/deducted in the

current financial year :

- First

calculate the Tax Liability of the current year including the arrears of salary

and excluding arrears of salary.

- Then

take the difference between the tax which is paid on total income including the

arrear salary, and Tax Which is to be paid on total income excluding the arrear

salary.

- This

gives the Excess Tax paid/deducted in the current financial year.

Step 2 : Calculate tax which is to be paid over

the arrears Salary, considering it as

the Income of the year to which it belongs :

- Now

calculate Tax Liability of the financial year to which arrear salary belong,

considering it is received in that year.

- This

will give actual tax to be paid in that year including arrear salary in total

taxable income.

Step 3 : Then it calculate the Tax dues of the

respective year to which arrear salary belong :

- As

you had already paid tax or reported your income in the previous financial year

to which arrear belongs by filing Income Tax Return.

- The

arrear salary will result in certain tax due which has to be paid in the current financial year.

Step

4 : Tax Relief :

- Calculate

excess Tax paid/deducted in the current financial year (as per Step 1) Less Tax

dues of the respective year to which arrear salary belong (as per Step 3)

- (Step

1) less (Step 3).

- This

will give you Tax Relief

Benefit

The

tax relief will be provided to you in the form of refund. As your will file

your income tax return after filing Form 10 E and then claim Section 89 Relief. You

will be provide a INCOME TAX REFUND.

If

wish to see practical example with explanation in simple way then go to the

link and see the real life example with values and refund amount : https://youtu.be/vN1gqT-yXpE

This is how one can save tax over his arrears of salary and advance. I hope you all liked the blog. Please don't forget to like and subscribe.

Do share this useful information with your family and friends. And feel free to share your comments.

Do follow,subscribe and like us at facebook, Instagram and youtube to keep getting such useful informations.

Visit our youtube page : www.youtube.com/c/TaxolawgyWithPriyankaTiwari

Visit our Instagram Account : https://www.instagram.com/taxolawgywithpriyankatiwari/

Visit our Facebook page : https://www.facebook.com/taxolawgywithpriyankatiwari/

Disclaimer :

The above blog is purely for educational and guidance purpose. It's just the reflection of the author's personal experience and judgment. The author has just provided the general information & understanding and its not at all an alternative of any legal advice or practitioner. The content stated in the blog should be used by the reader at his own discretion and sole responsibility. The content of the blog can be only used for any other document, write-up, article, blog and any written or printed material whether on paper or digitally in any form, with the prior permission of the author.